Corporate Cards for Businesses

a B2B Fintech Solution for streamlining expense management for businesses through cards

Role: Ui Ux Designer, Product management, UX Researcher

Problem Statement

In Pakistan's corporate landscape, traditional methods of managing office expenses through personal debit cards present numerous challenges for businesses. Without dedicated solutions tailored to the needs of modern enterprises, companies face inefficiencies, lack of control, and limited oversight over expenditure. Moreover, the inability to issue cards to employees further complicates expense management processes, hindering productivity and financial transparency.

Challenges

Inefficiencies: Traditional methods lead to time-consuming and manual expense tracking, often resulting in errors and delays in reimbursement.

Lack of Control: Without dedicated corporate cards, companies struggle to enforce spending policies, leading to unauthorized purchases and overspending.

Limited Oversight: The inability to monitor real-time expenses hampers financial transparency and inhibits proactive budget management.

Employee Card Issuance: The absence of a streamlined process for issuing cards to employees complicates expense management and increases administrative burden.

Impact on Businesses

Operational Inefficiencies: Manual processes hinder operational efficiency, diverting resources from core business activities.

Financial Risks: Lack of control and oversight expose businesses to financial risks, including fraud and budget overruns.

Compliance Challenges: Inadequate expense tracking and reporting processes make it difficult for businesses to comply with regulatory requirements.

Employee Satisfaction: Delayed reimbursements and complex expense reporting processes can impact employee morale and productivity.

Recognizing these pain points, there was a pressing need for a comprehensive B2B fintech solution that empowers businesses to issue and manage corporate debit cards efficiently, enabling seamless tracking, customizable controls, and streamlined expense management for improved operational effectiveness.

Target Audience:

Small and Medium-sized Enterprises (SMEs)

Startups and Entrepreneurial Ventures

E-commerce and Online Businesses

Features

Dual Dashboards:

Seamlessly manage both Physical and Virtual cards. Physical cards enable payments, ATM withdrawals, and in-store purchases, while Virtual cards facilitate secure online transactions, both domestically and internationally.

Custom Card Requests:

Empower employees to request cards tailored to their needs, complete with customizable limits and controls. Administrators can efficiently approve these requests or create cards directly for employees with specified parameters.

Enhanced Security Features:

Safeguard your finances with the ability to freeze or block cards as needed, ensuring peace of mind against unauthorized usage.

Transaction Transparency:

Monitor transaction reliability with a built-in failed transaction counter, allowing cardholders to track unsuccessful transactions due to reasons such as insufficient balance. This counter, resettable with a nominal fee, promotes accountability and prevents automatic card blocking after a certain threshold, with administrators gaining insights into employee transaction histories.

Flexible Spending Limits:

Set and adjust monthly spending limits effortlessly. Cardholders and administrators alike have clear visibility into these limits, fostering responsible spending habits and financial oversight.

Tailored Card Creation:

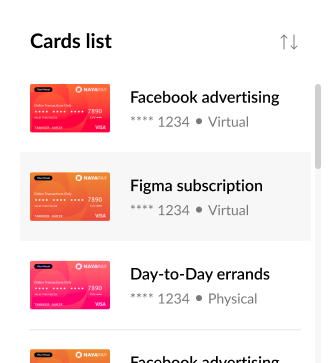

Create multiple cards for diverse purposes, optimizing financial organization. For instance, designate a virtual card exclusively for recurring payments like Figma subscriptions, streamlining expense management.

Customized Control Settings:

Exercise comprehensive control over card usage. Administrators can enforce restrictions such as limiting international transactions or specifying local-only usage, empowering businesses to align card usage with organizational policies and preferences.

Process

Basic journey mapped onto Figjam

Iterations

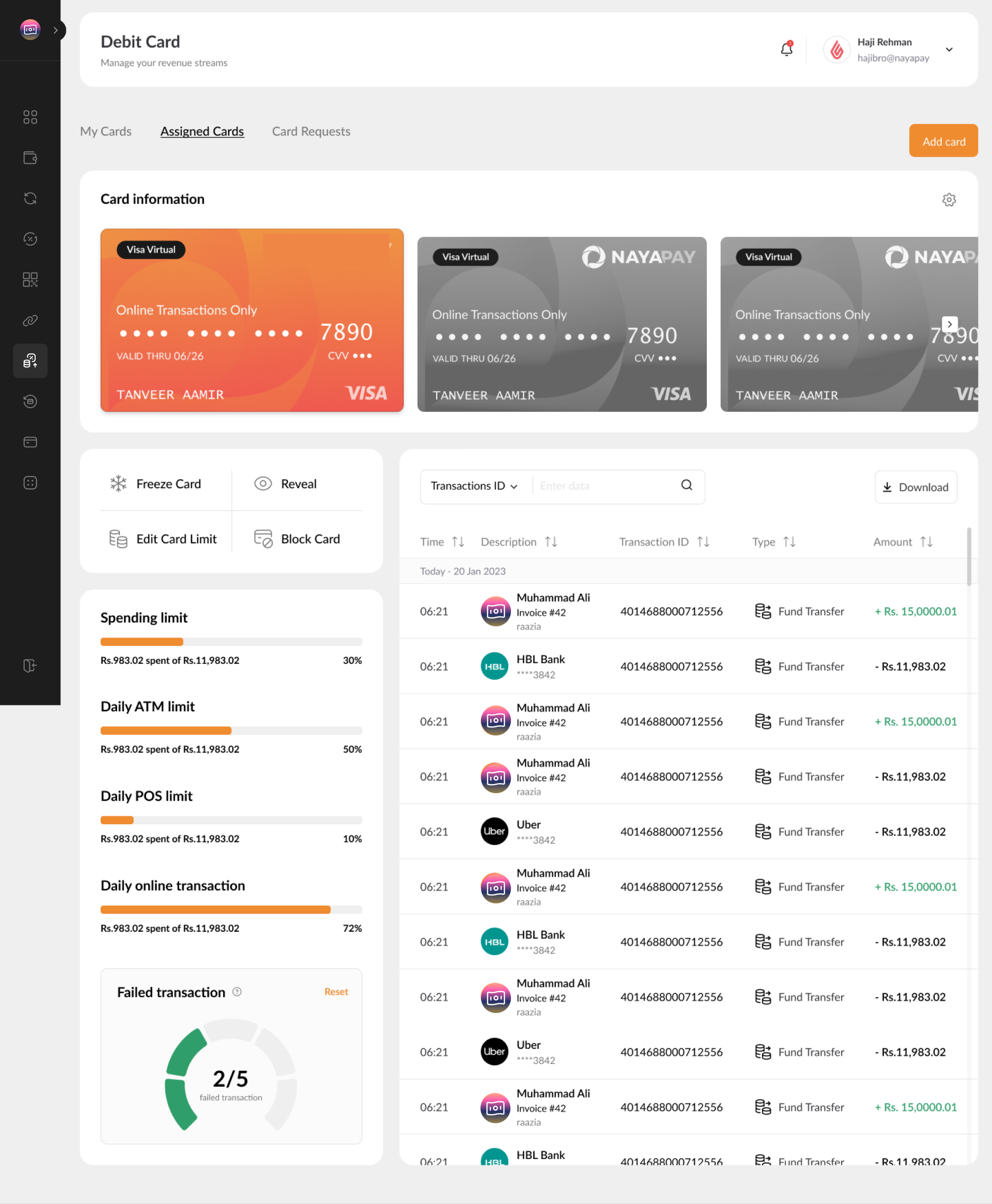

After researching on what exactly the user would need - and how often they would need that particular feature - we came up with the dashboard for the cards. The overview shows all the functionalities of the respective corporate card at your fingertips - ranging from limits to advanced controls to freezing the card etc. The design was created in line with NayaPay’s design system and clean aesthetic in terms of branding. The priority here was to design a dashboard that shows the data and controls in the simplest possible way to avoid cognitive overload.

Physical Card vs. Virtual Card dashboard

(Retaining the same layout and adjusting to the difference in limits and controls)

Components

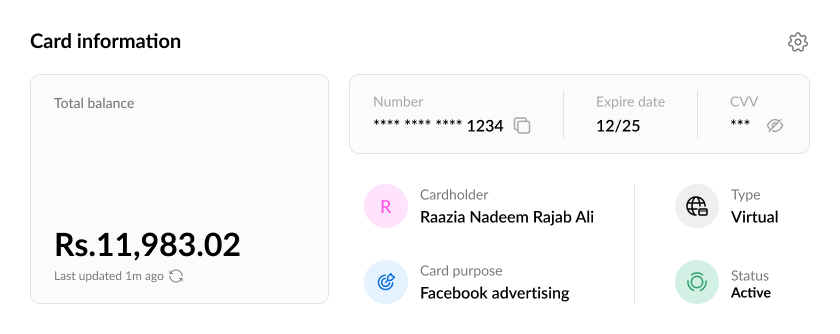

The Corporate Card is a central element of the dashboard, offering key controls and functionalities for seamless management. To enhance security, the card number is initially hidden. By clicking the "Reveal" button and entering a password, users can easily access the card number.

The card interface is designed for intuitive use, ensuring that all essential information is readily available. The purpose of the card is prominently displayed at the top, providing a clear understanding of its intended use. Additionally, users can easily identify whether the card is virtual or physical, simplifying the navigation process.

The Failed Transactions Counter is a vital component of the Cards dashboard, reflecting NayaPay's commitment to maximizing security. This feature detects suspicious activities and records failed transactions, ensuring users are informed promptly.

Beyond security, this feature is crucial for managing transactions when account balances are low. If a transaction is attempted with insufficient funds, it is marked as failed and recorded. After five failed transactions, the card is automatically blocked, requiring users to request a new one.

The counter displays five bars, each representing a potential failed transaction. As a transaction fails, a bar turns red, alerting the user. By clicking the expand button (arrow), users can view specific failed transactions and access a reset button to address them.

The Freeze Card feature provides a convenient control on the dashboard for users to address suspicious or unauthorized activity. This option allows users to temporarily freeze their card, preventing any further transactions. A pop-up window appears when the user clicks on the designated button in the dashboard, facilitating a seamless user experience.

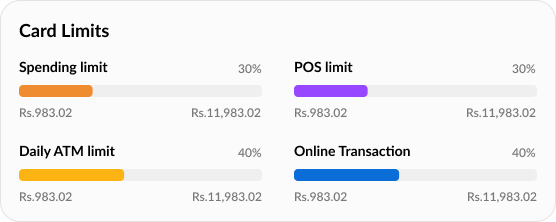

The Card Limits feature provides a comprehensive view of different limits and their utilization, streamlining tracking for users. Through multiple iterations and extensive user research and testing, this design was refined to ensure usability and effectiveness.

For a more permanent solution, users can choose to block their card. This action is particularly useful in cases of suspected fraud or when a card needs to be permanently deactivated. Administrators also have the capability to block a card for an employee, such as when an employee is terminated, ensuring that the card is removed from the system.

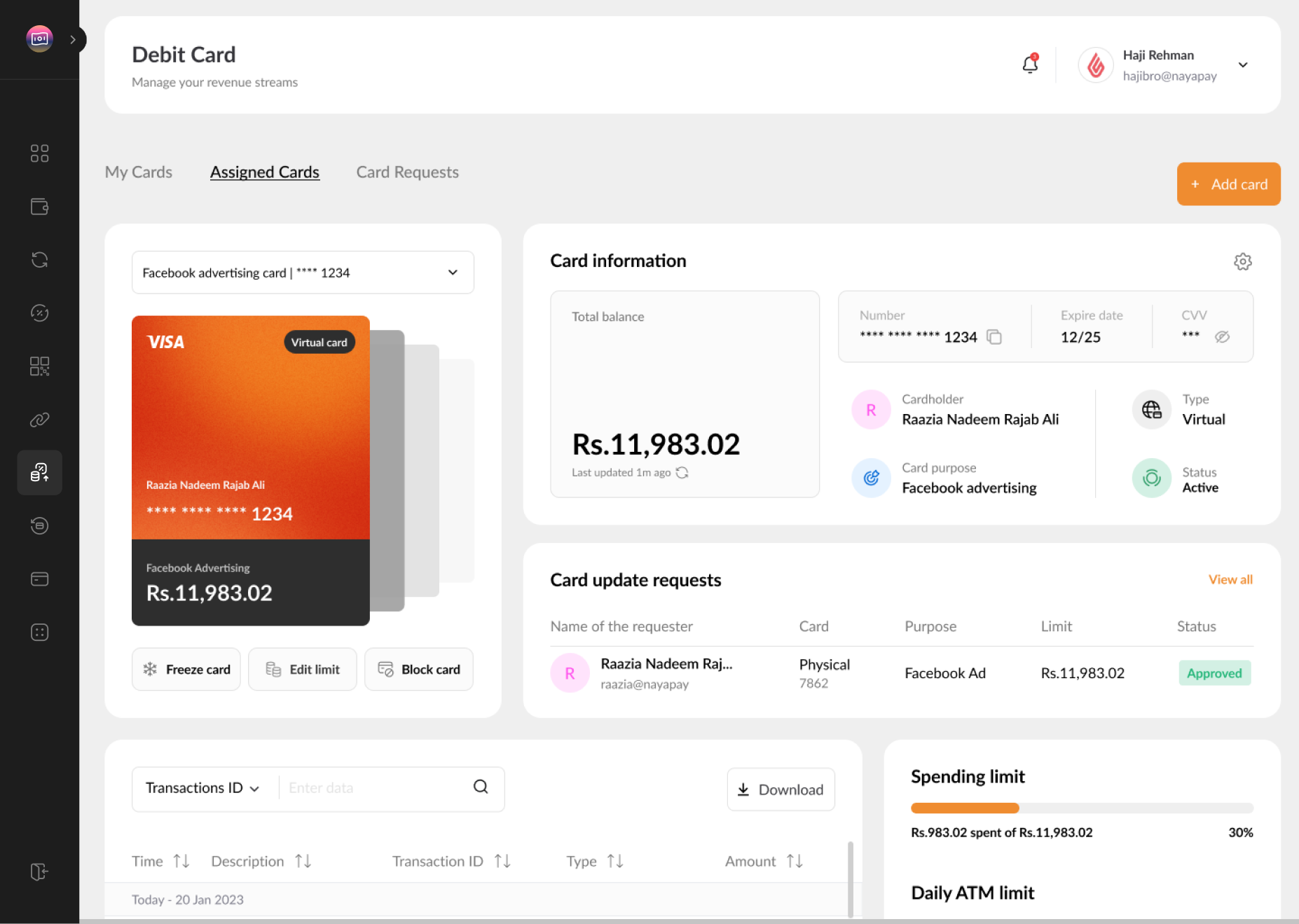

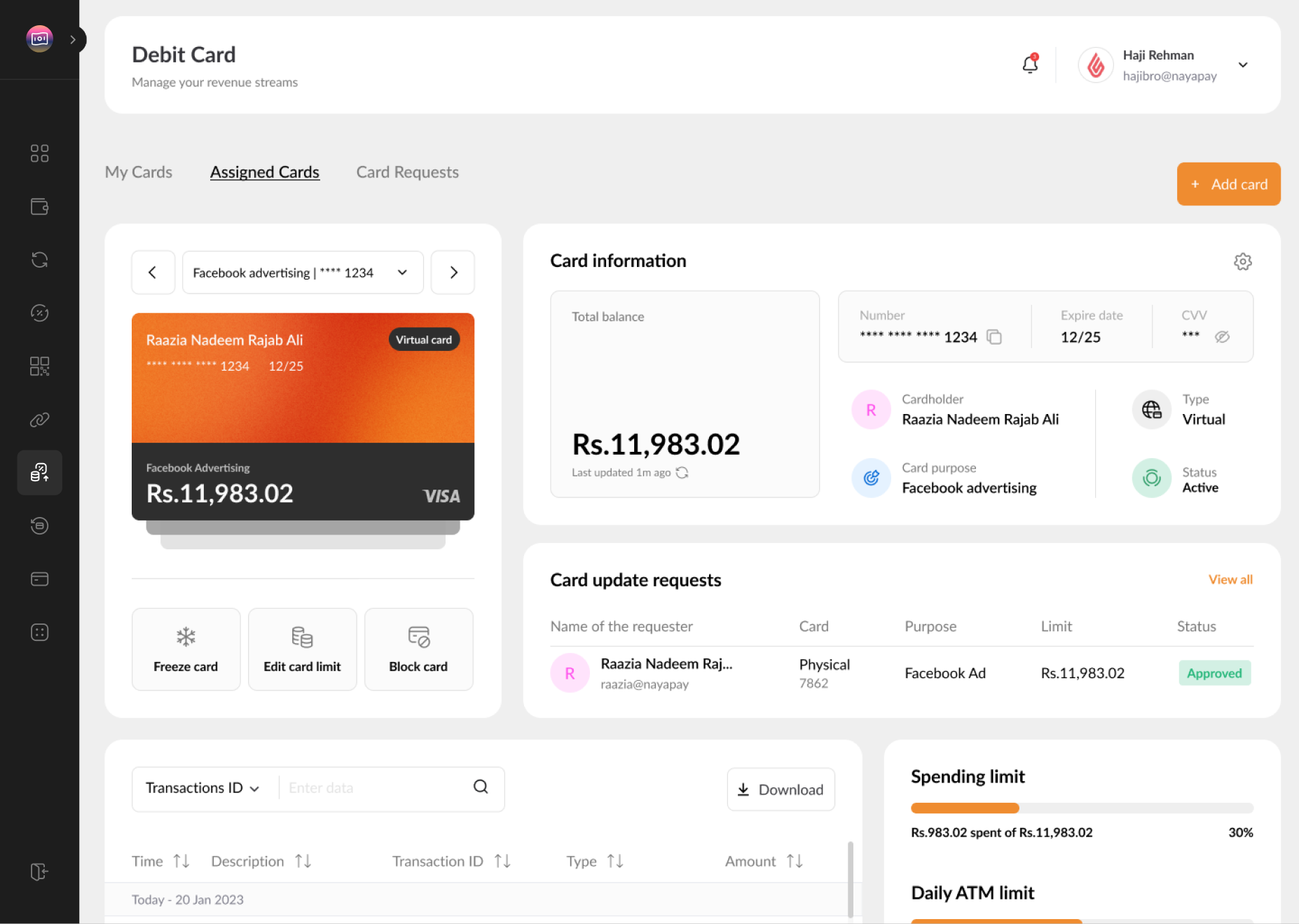

Assigned Cards

Admins have additional controls on the portal compared to regular employees. While employees have autonomy over their own cards, admins can oversee and manage both their own and their employees' cards, including the ability to restrict them when necessary.

To optimize this feature, admins have access to two distinct dashboards. One dashboard displays their own cards, along with their limits and controls. The other tab shows all cards assigned to their employees or team members.

The view of assigned cards underwent several iterations to determine the essential information to display per card in the list for the admin, with additional details available in a side drawer upon clicking any row. The key features include the cardholder's name (the employee the card belongs to), the purpose of the card (e.g., travel, office supplies) and its type (physical or virtual), the spending limit utilized on the card, and an approval column to track whether they need to accept or deny card requests.

To enhance efficiency, a search bar and filters were added to assist admins in locating specific cards. The design ensures that the list remains minimal and clean, conveying all essential information without overwhelming the admin.

Impact

The implementation of these comprehensive features within the B2B fintech product for corporate cards has catalyzed a transformative impact on businesses in Pakistan. By bridging the gap between traditional expense management methods and contemporary demands for efficiency and control, this solution has revolutionized how companies manage their finances. The ability to issue both physical and virtual cards, coupled with customizable limits and controls, empowers employees while providing administrators with unparalleled oversight. Enhanced security measures, transparent transaction tracking, and flexible spending limits further reinforce financial integrity and accountability within organizations. With the freedom to tailor card usage and controls to specific needs, businesses can streamline operations, optimize expenditure, and cultivate a culture of fiscal responsibility. Ultimately, the impact of these features extends far beyond mere transactional convenience; it represents a paradigm shift in corporate expense management, paving the way for increased productivity, transparency, and financial stability in the Pakistani business landscape.